The digital revolution has reshaped finance—making it faster, borderless, and increasingly automated. Yet as financial technology (fintech) accelerates, it also raises fundamental questions about ethics, inclusion, trust, and responsibility. For the Islamic economy, this moment presents not a dilemma, but an opportunity.

Islamic Fintech represents the convergence of Shariah principles with digital innovation, offering financial solutions that are technologically advanced while remaining ethically grounded. It is not about retrofitting conventional fintech with Islamic labels; it is about reimagining finance itself—so that innovation serves people, purpose, and the real economy.

At Islamic Economy Academy, Islamic fintech is understood as a strategic pillar of the modern halal economy and a powerful tool for inclusive, values-led financial transformation.

What Is Islamic Fintech?

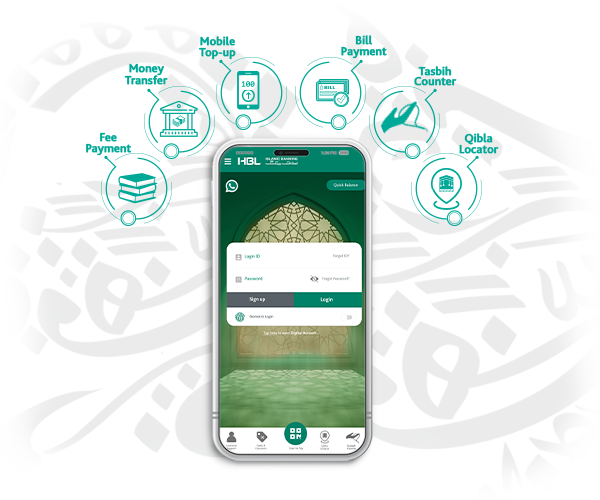

Islamic fintech refers to the use of digital technologies—such as mobile platforms, APIs, AI, blockchain, and data analytics—to deliver Shariah-compliant financial services.

These services span:

- Digital banking and wallets

- Payments and remittances

- Financing and investment platforms

- Zakat, waqf, and social finance tools

- Takaful (Islamic insurance) tech

- Compliance, governance, and regtech

What differentiates Islamic fintech is not the technology itself, but the ethical framework guiding its design, deployment, and outcomes.

The Shariah Foundations Behind Islamic Fintech

Islamic fintech is anchored in Fiqh al-Muʿāmalāt, the body of Islamic commercial jurisprudence that governs economic transactions. Its core principles include:

1. Prohibition of Ribā (Interest)

Income must be earned through real economic activity, risk-taking, or value creation—not guaranteed returns on money alone.

2. Avoidance of Gharar and Maysir

Transactions must avoid excessive uncertainty, deception, and speculative gambling.

3. Asset-Backed and Risk-Sharing Models

Financing should be linked to identifiable assets or services, with shared risk and reward.

4. Ethical Use of Capital

Funds must not be deployed in harmful or prohibited industries—even if profitable.

5. Maqāṣid al-Sharīʿah (Higher Objectives)

Islamic fintech should promote:

- Justice

- Financial inclusion

- Protection of wealth

- Social wellbeing

Technology becomes a means to uphold objectives, not bypass them.

Core Segments of the Islamic Fintech Ecosystem

1. Digital Islamic Banking and Wallets

Digital-first Islamic banks and wallets provide:

- Shariah-compliant accounts

- Ethical payment and transfer services

- Integrated budgeting and savings tools

- Seamless cross-border remittances

These platforms focus on accessibility, transparency, and trust, especially for underserved populations and digital-native users.

2. Islamic Financing Platforms

Islamic fintech is transforming access to finance through:

- Murābaḥah-based digital trade finance

- Mushārakah and Muḍārabah crowdfunding

- SME and microfinance platforms

- Asset-backed consumer financing

Digital platforms reduce friction while maintaining contractual clarity and Shariah oversight.

3. Islamic Investment and WealthTech

Wealthtech solutions enable:

- Halal portfolio screening

- Robo-advisory aligned with Shariah filters

- Digital sukuk access

- Fractional ownership in halal assets

Investors gain convenience without compromising conscience.

4. Zakat, Waqf, and Social Finance Tech

One of the most transformative areas of Islamic fintech is social finance.

Digital platforms now enable:

- Automated zakat calculation and distribution

- Transparent waqf management

- Impact tracking and reporting

- Integration of charity with microfinance and empowerment

Technology amplifies mercy, efficiency, and accountability at scale.

5. Takaful (Islamic Insurance) Tech

Islamic insurtech platforms offer:

- Cooperative risk-sharing models

- Digital onboarding and claims

- Micro-takaful for low-income users

- Transparent contribution and surplus sharing

These solutions make protection accessible, affordable, and ethical.

Governance, Compliance, and Trust in Islamic Fintech

Trust is the currency of finance—especially digital finance.

Islamic fintech requires:

- Strong Shariah governance frameworks

- Independent Shariah supervision

- Clear disclosure and reporting

- Ethical data use and privacy protection

- Alignment between product substance and structure

Without governance, fintech risks becoming formally compliant but ethically hollow.

Technology as an Enabler, Not a Master

AI, blockchain, and automation offer immense potential—but also ethical risks.

Islamic fintech must ensure:

- Algorithms do not embed injustice or bias

- Automation does not remove accountability

- Speed does not override consent and clarity

- Data is treated as a trust, not an asset to exploit

Technology must serve ethical objectives, not dictate them.

Challenges Facing Islamic Fintech

Despite its promise, Islamic fintech faces key challenges:

- Regulatory fragmentation across jurisdictions

- Shortage of skilled Shariah–tech professionals

- Over-reliance on conventional structures

- Balancing innovation with authenticity

Overcoming these challenges requires:

- Education and capacity building

- Supportive regulation

- Ethical investment

- Cross-sector collaboration

Why Islamic Fintech Matters in the Digital Age

Islamic fintech is not only for Muslims.

Its principles—fairness, transparency, risk-sharing, and inclusion—appeal to anyone seeking ethical alternatives to debt-driven finance.

In an age of:

- Rising inequality

- Financial exclusion

- Distrust in institutions

Islamic fintech offers a values-led digital financial future.

Conclusion: Designing Finance with Faith and Foresight

Islamic fintech is more than a technological upgrade—it is a philosophical reset.

It demonstrates that:

- Faith and innovation can reinforce each other

- Digital finance can be ethical and scalable

- Profit can coexist with purpose

When finance is guided by values and powered by technology,

innovation becomes responsible,

growth becomes inclusive,

and the digital economy gains a moral compass.

At Islamic Economy Academy, we believe Islamic fintech fundamentals will shape the next era of global finance—one where faith informs design, technology enhances trust, and finance serves humanity.

Explore more insights, courses, and frameworks on Islamic fintech, ethical finance, and the future of the halal digital economy at Islamic Economy Academy.