How Islam Provides a Real, Sustainable Solution for Humanity

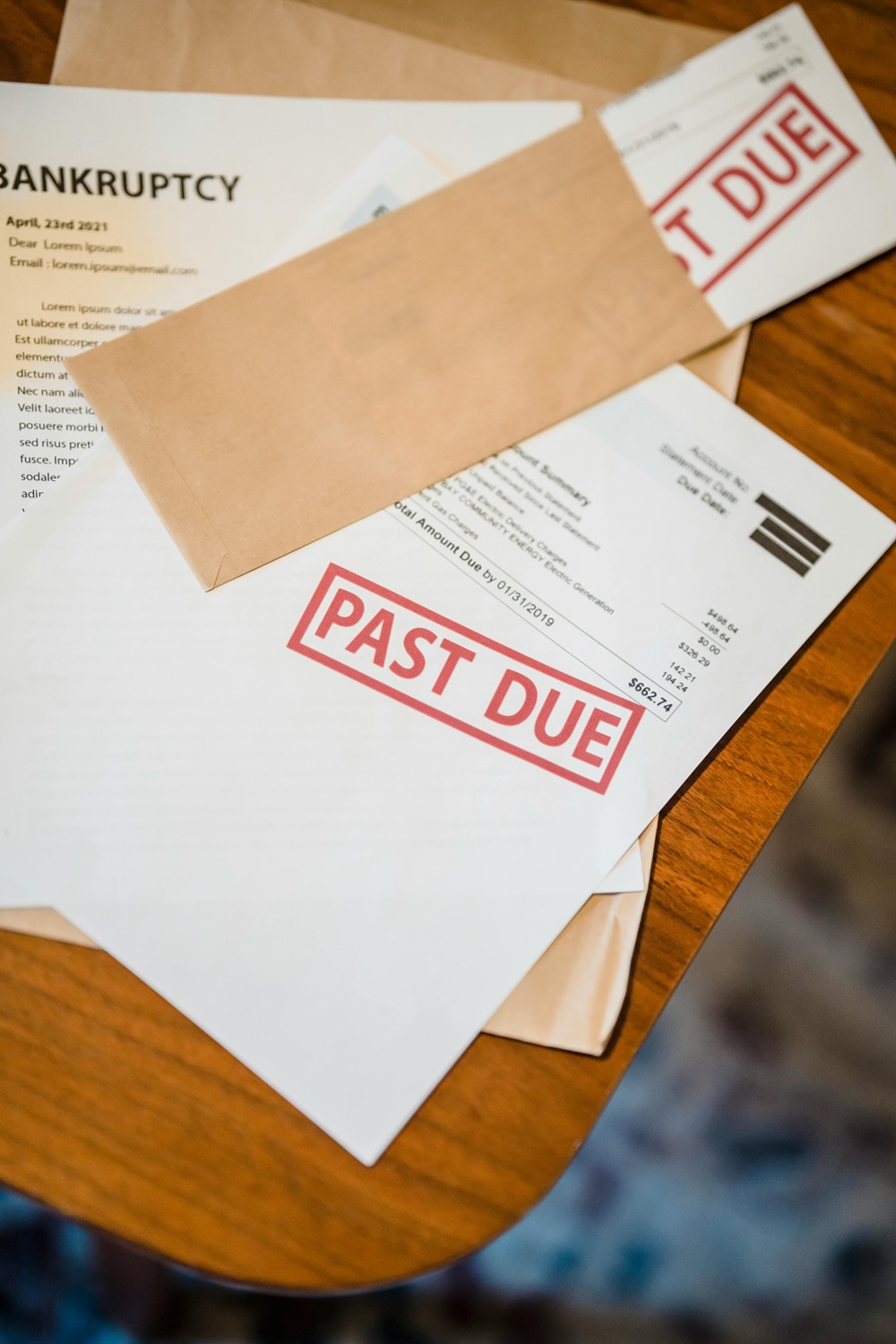

A World Trapped in Recurring Financial Crises

The modern global economy is trapped in a cycle of recurring financial crises. From the Great Depression to the 2008 financial crash, from sovereign debt crises to inflationary shocks and widening inequality, the pattern is clear:

• Excessive debt

• Speculation detached from real value

• Concentration of wealth

• Fragile financial systems

• Moral hazard and systemic injustice

Despite technological advancement, financial engineering, and policy reforms, the crises persist — often growing deeper and more destructive.

This raises an important question:

Is the problem technical… or is it moral and structural?

Islam answers this clearly:

The crisis is not a lack of intelligence or tools — it is a failure of values, accountability, and balance.

Islam offers not a temporary fix, but a comprehensive economic worldview designed to prevent such crises at their root.

Understanding the Root Causes of Global Financial Crises

1. Debt-Based Economic Systems

Modern economies are built on interest-based debt, where money is created through lending rather than real productivity.

This leads to:

- Excessive leverage

- Asset bubbles

- Unsustainable consumption

- Economic instability

Debt grows faster than real economic output, inevitably causing collapse.

2. Speculation and Financialization

Much of modern finance is disconnected from the real economy:

- Derivatives trading

- Speculative instruments

- Artificial asset inflation

- High-frequency trading

Wealth is generated without producing real value — a clear violation of economic justice.

3. Concentration of Wealth

Global systems allow wealth to accumulate in the hands of a few while:

- Middle classes shrink

- Poverty expands

- Social mobility declines

This imbalance destabilizes societies and fuels unrest.

4. Moral Hazard and Lack of Accountability

Institutions take excessive risks knowing:

- Governments will bail them out

- Losses will be socialized

- Profits will remain private

This erodes ethical responsibility and encourages recklessness.

Islamic Economics: A Value-Based Alternative

Islam does not view economics as morally neutral. It is built upon:

- Justice (ʿadl)

- Balance (mīzān)

- Responsibility (amānah)

- Compassion (raḥmah)

- Social welfare (maṣlaḥah)

Allah says:

“…So that wealth does not circulate only among the rich among you…”

(Qur’an 59:7)

This verse alone captures the essence of Islamic economic philosophy.

Core Islamic Economic Principles That Prevent Crises

1. Prohibition of Riba (Interest)

Riba is not merely a religious prohibition — it is an economic safeguard.

Why Interest Causes Crises:

- Encourages debt-driven growth

- Creates guaranteed profit without risk

- Transfers wealth from poor to rich

- Leads to systemic instability

Islam replaces interest with:

- Risk-sharing

- Asset-backed financing

- Profit-and-loss participation

This aligns incentives and prevents reckless lending.

2. Risk-Sharing Instead of Risk-Shifting

In Islamic finance:

- Profit requires exposure to risk

- Losses are shared fairly

- Speculation is discouraged

Models such as:

- Mushārakah (partnership)

- Muḍārabah (profit-sharing)

ensure that finance supports real economic activity.

This prevents bubbles and collapses driven by artificial credit expansion.

3. Real Economy Linkage

Islam requires that financial transactions be:

- Asset-backed

- Value-generating

- Linked to real goods or services

This eliminates:

- Paper trading

- Excessive speculation

- Abstract financial instruments

The result is economic stability rooted in real productivity.

4. Zakat: Built-in Economic Stabilizer

Zakat is not charity — it is an economic institution.

It:

- Redistributes wealth

- Stimulates consumption

- Reduces inequality

- Prevents hoarding

- Supports vulnerable populations

Unlike taxes, zakat:

- Is mandatory

- Is purpose-specific

- Flows directly to society

- Circulates wealth naturally

During crises, zakat functions as an automatic stabilizer.

5. Prohibition of Hoarding and Market Manipulation

Islam strongly condemns:

- Hoarding essential goods

- Artificial price inflation

- Market monopolization

The Prophet ﷺ said:

“Whoever hoards is a sinner.”

(Jami` at-Tirmidhi)

This prevents:

- Supply manipulation

- Inflation spikes

- Social unrest

6. Ethical Wealth Circulation Through Waqf

Waqf (endowment) historically funded:

- Education

- Healthcare

- Infrastructure

- Social welfare

It reduced government burden and created sustainable social support systems — long before modern welfare states.

Islamic Economic Solutions to Modern Crises

| Global Problem | Islamic Solution |

|---|---|

| Debt crisis | Interest-free finance |

| Wealth inequality | Zakat & inheritance laws |

| Financial instability | Risk-sharing |

| Market bubbles | Asset-backed finance |

| Poverty | Zakat + Waqf |

| Unemployment | Entrepreneurship & SME support |

| Inflation | Ethical pricing & anti-hoarding |

| Social unrest | Economic justice |

Why Islamic Economics Is More Relevant Today Than Ever

Modern economists increasingly acknowledge:

- Limits of debt-based growth

- Failures of trickle-down economics

- Need for ethical finance

- Importance of sustainability

Islam addressed these issues 1,400 years ago.

Its system:

✔ Prevents exploitation

✔ Encourages productivity

✔ Protects dignity

✔ Balances freedom and responsibility

✔ Aligns economics with morality

The Path Forward: Implementing Islamic Economic Solutions

1. Policy-Level Adoption

- Interest-free financial frameworks

- Zakat integration into welfare systems

- Support for Islamic banking

2. Institutional Reform

- Ethical banking standards

- Transparency requirements

- Risk-sharing mechanisms

3. Community-Level Action

- Waqf revival

- Cooperative enterprises

- Islamic microfinance

4. Individual Responsibility

- Ethical consumption

- Avoidance of debt

- Honest trade

- Wealth circulation

Conclusion: Islam Offers a Civilizational Solution

The global economic crisis is not merely financial — it is moral.

Islam offers a system that:

- Prevents exploitation

- Encourages justice

- Promotes shared prosperity

- Aligns wealth with responsibility

It does not promise unchecked growth —

it promises sustainable, ethical prosperity.

“And establish weight in justice and do not make deficient the balance.”

(Qur’an 55:9)

This is the foundation of Islamic economics.

And in a world searching for stability, dignity, and fairness — Islam offers a complete solution.