Introduction

Fiqh, or Islamic jurisprudence, encompasses all aspects of a Muslim’s life, providing comprehensive guidance on matters of worship, social transactions, and personal conduct. One of the critical areas of Fiqh is “Muamulaat,” which refers to the legal and ethical aspects of interactions and transactions between individuals. This includes business dealings, trade, finance, and other commercial activities. As Muslims engage in business, it is imperative to align business practices with the principles of Islamic law to ensure business transactions are ethical, just, and compliant with Shariah.

Core Principles of Muamulaat in Business

Before starting a business, a Muslim must understand the foundational principles of Muamulaat:

- Halal and Haram (Permissible and Prohibited):

- The primary consideration in any business is whether the goods and services are Halal (permissible) or Haram (prohibited). Business activities must avoid dealings in alcohol, pork, gambling, interest (riba), and other prohibited items or activities.

- Riba (Interest):

- Islam strictly prohibits riba, which is the fixed, predetermined interest charged on loans. Any business model involving riba is forbidden. Instead, profit-sharing models like Mudarabah (profit-sharing) and Musharakah (joint venture) are encouraged.

- Gharar (Uncertainty or Deception):

- Transactions should be free from excessive uncertainty and deception. Clear terms and conditions must be established to avoid ambiguity, ensuring transparency and fairness in business dealings.

- Justice and Fairness:

- Islamic business ethics emphasize justice and fairness. All parties involved in a transaction should be treated equitably, ensuring that no party is exploited or cheated.

- Zakat (Almsgiving):

- Businesses are required to pay Zakat on their earnings, a form of obligatory charity that purifies wealth and aids in the equitable distribution of resources within the community.

Key Islamic Business Contracts

Several types of contracts are recognized in Islamic law, each with specific rules and conditions:

- Mudarabah (Profit-sharing partnership):

- In this contract, one party provides capital, and the other provides expertise and management. Profits are shared according to a pre-agreed ratio, while losses are borne by the capital provider unless caused by negligence.

- Musharakah (Joint venture):

- This is a partnership where all partners contribute capital and share profits and losses according to their investment ratios. It promotes shared risk and reward.

- Murabaha (Cost-plus financing):

- A sale contract where the seller discloses the cost and profit margin. It is commonly used in Islamic banking to finance the purchase of goods.

- Ijara (Leasing):

- This involves leasing an asset for a specific period and price. The lessor retains ownership, while the lessee benefits from using the asset.

- Istisna (Manufacturing contract):

- A contract for manufacturing goods and commodities, allowing cash payment in advance and future delivery or a sale with an obligation on the part of the manufacturer to produce goods with specifications.

Ethical Considerations in Islamic Business

Muslim entrepreneurs must adhere to ethical standards derived from Islamic teachings:

- Honesty and Integrity:

- Honesty is a cornerstone of Islamic ethics. Businessmen should avoid lying, fraud, and deceit in their transactions.

- Transparency:

- Clear communication about the product, service, pricing, and terms of the contract is essential. Misrepresentation or withholding information is considered unethical.

- Trust and Fulfillment of Contracts:

- Trustworthiness and fulfilling promises are crucial. Once a contract is made, it should be honored and fulfilled as agreed.

- Social Responsibility:

- Businesses should contribute positively to society, avoiding harm and considering the welfare of the community. Corporate social responsibility and ethical treatment of employees and customers are highly encouraged.

- Moderation and Avoidance of Extravagance:

- Islam encourages moderation and discourages extravagance and waste. Business expenditures should be prudent, and profits should be used responsibly.

Practical Steps for Starting a Business in Compliance with Shariah

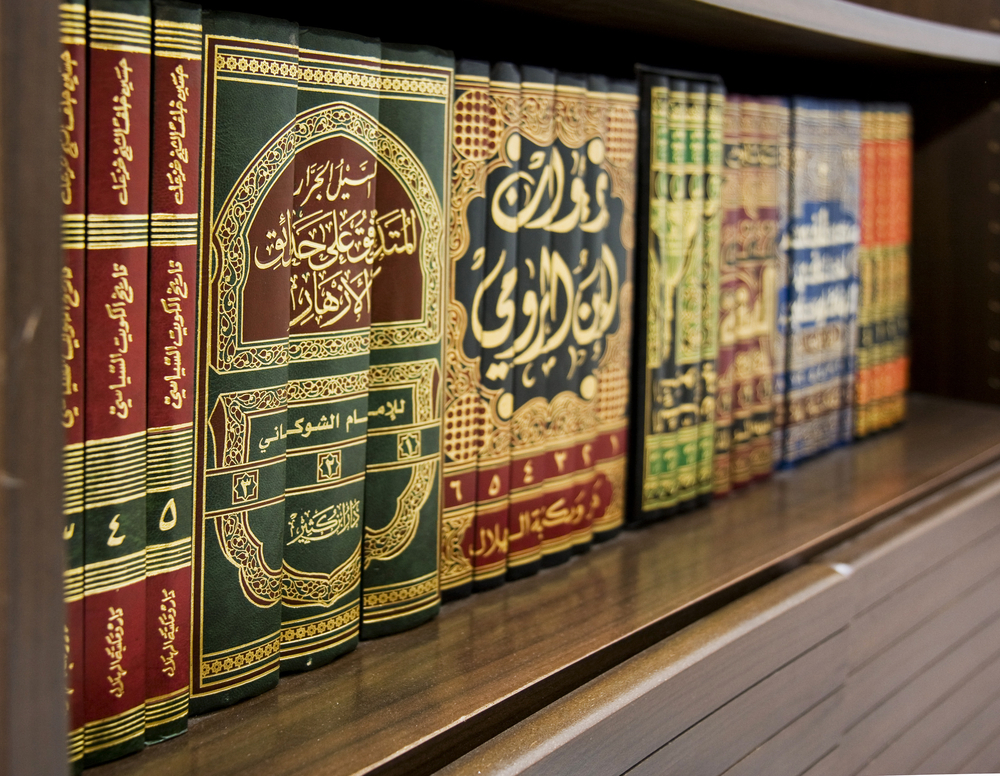

- Seek Knowledge and Guidance:

- Understanding the principles of Islamic finance and business is crucial. Consulting with knowledgeable scholars and attending relevant courses can provide valuable insights.

- Develop a Shariah-Compliant Business Plan:

- Create a business plan that adheres to Islamic principles, including sources of funding, types of transactions, and the nature of goods and services offered.

- Choose the Right Business Structure:

- Select a business structure that facilitates Shariah compliance, such as partnerships or equity-based financing, avoiding interest-based loans.

- Implement Ethical Business Practices:

- Establish policies and procedures that promote ethical behavior, transparency, and accountability in all business dealings.

- Regularly Review and Audit Business Practices:

- Continuously review business operations to ensure ongoing compliance with Shariah. Regular audits by Shariah experts can help maintain adherence to Islamic principles.

Conclusion

The fiqh of Mu’amalaat provides comprehensive guidelines for Muslims engaging in business. By adhering to the principles of honesty, fairness, mutual consent, prohibition of interest and uncertainty, and ethical conduct, Muslims can ensure their business practices align with Islamic teachings. Understanding and implementing these principles not only brings success in this world but also earns Allah’s pleasure and blessings in the hereafter. As with all aspects of life, a sincere intention and continuous effort to adhere to Islamic principles are key to achieving success in business while maintaining one’s faith and integrity.