In recent years, the global financial landscape has experienced a remarkable transformation through the advent of financial technology, or FinTech. This revolution, characterized by innovations such as blockchain, mobile payments, and digital banking, has not only enhanced the efficiency of financial services but has also democratized access to them. Among the various branches of FinTech, Islamic FinTech stands out as a unique and rapidly growing sector. It harmoniously blends the principles of Islamic finance with cutting-edge technology, catering to a burgeoning demand for Sharia-compliant financial solutions.

Understanding Islamic Finance

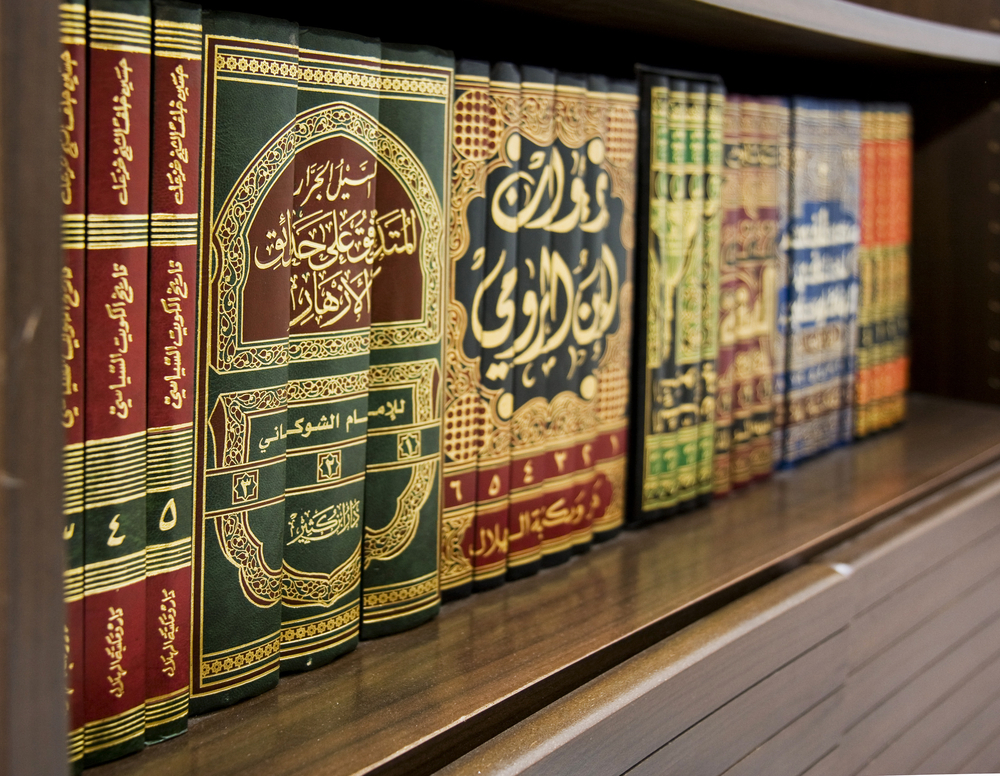

Islamic finance is rooted in the principles of Sharia, the Islamic legal system derived from the Quran and Hadith. These principles emphasize ethical, equitable, and socially responsible financial practices. The core tenets of Islamic finance include:

- Prohibition of Interest (Riba): Islamic finance strictly prohibits the charging or paying of interest. Instead, it promotes profit-sharing arrangements and trade-based transactions.

- Risk Sharing: Financial transactions should involve risk-sharing and mutual cooperation. Both profit and loss are to be shared among the parties involved.

- Asset-Backed Financing: Transactions must be backed by tangible assets or services, ensuring that money is not treated as a commodity in itself.

- Prohibition of Uncertainty (Gharar): Contracts should be clear and free from excessive uncertainty or ambiguity to ensure fairness and transparency.

- Ethical Investments: Investments must align with Islamic ethical standards, avoiding businesses related to alcohol, gambling, and other prohibited activities.

The Rise of Islamic FinTech

Islamic FinTech represents the intersection of these foundational principles with modern technology. It leverages digital innovation to provide Sharia-compliant financial services, making them more accessible, efficient, and user-friendly. The growth of Islamic FinTech can be attributed to several factors:

- Growing Muslim Population: With over 1.8 billion Muslims worldwide, there is a significant demand for financial products that adhere to Islamic principles.

- Digital Adoption: The widespread adoption of smartphones and internet connectivity has facilitated the penetration of FinTech solutions, even in regions with limited traditional banking infrastructure.

- Regulatory Support: Many countries with significant Muslim populations are creating supportive regulatory frameworks to encourage the development of Islamic FinTech.

Key Components of Islamic FinTech

Islamic FinTech encompasses a wide range of financial services, including banking, investment, insurance, and charitable giving. Here are some key components:

- Islamic Digital Banking: Digital banks offering Sharia-compliant products such as savings accounts, financing, and investment services. These banks use technology to provide seamless, user-friendly experiences while adhering to Islamic principles.

- Crowdfunding and P2P Lending: Platforms that facilitate peer-to-peer lending and crowdfunding based on profit-and-loss sharing models, ensuring that transactions are free from interest.

- Blockchain and Smart Contracts: Blockchain technology is used to enhance transparency and trust in financial transactions. Smart contracts can automate compliance with Sharia principles, ensuring that all terms and conditions are met.

- Robo-Advisors: Automated investment advisory services that offer Sharia-compliant investment portfolios, making ethical investing accessible to a broader audience.

- Insurtech (Takaful): Digital platforms providing Islamic insurance (Takaful), which operates on the principle of mutual assistance and risk-sharing.

Challenges and Opportunities

While Islamic FinTech holds immense promise, it also faces several challenges:

- Regulatory Divergence: Different interpretations of Sharia law across countries can lead to inconsistent regulatory standards, complicating cross-border operations.

- Consumer Awareness: Many potential users are still unaware of the availability and benefits of Islamic FinTech products.

- Technological Integration: Integrating traditional Islamic finance principles with modern technology requires significant innovation and investment.

However, these challenges present opportunities for growth and development:

- Standardization Efforts: Initiatives to standardize Sharia compliance guidelines can facilitate smoother operations across different regions.

- Educational Campaigns: Increasing awareness through educational campaigns can drive adoption and trust in Islamic FinTech solutions.

- Collaborative Innovation: Partnerships between traditional Islamic financial institutions and FinTech companies can foster innovative solutions that adhere to Sharia principles while leveraging the latest technology.

Conclusion

Islamic FinTech is poised to reshape the financial landscape by providing ethical, transparent, and accessible financial services to the global Muslim population. By integrating the timeless principles of Islamic finance with the dynamic capabilities of modern technology, Islamic FinTech offers a compelling alternative to conventional financial systems. As the sector continues to evolve, it holds the potential to not only serve the needs of Muslim consumers but also to contribute to a more inclusive and equitable global financial system.